Becoming a professional trader requires lots of invested effort, time, patience, and willingness to learn. If you are ready to take that path and be committed, you will see that after some time of trading crypto you are gaining more and more experience. Every expert trader knows that he can only improve trading skills through practice and discipline. Additionally, it is important to make a rational decision.

Every day we are seeing different reports on the Internet about cryptocurrencies and the trading market. In fact, you will be surprised how many different trading platforms are out there where you can find more information about how people can perform trading actions.

Be motivated and bold to enter every trade

Source: unsplash.com

Even though this can seem like an obvious tip, it is still very important for the trader to know why he wants to take this road. More precisely, it is necessary for everyone who wants to make a huge profit out of this activity to have a clear purpose for getting into trading. It does not matter whether you want to day trade or choose a scalping strategy, you need to have a purpose for doing that and be responsible.

Additionally, it is important to realize that for every win that is going to be a corresponding loss. Trading comes with both winnings and losses. Therefore, no matter what type of trader you are and what kind of strategy you are following, sometimes it would be the best decision to not gain anything on a particular trade than to rush and lose everything. In fact, analysis actually shows that you can go profitable by just keeping off some trades. Remember that tip, it is very effective.

You need to set profit targets and take advantage of stop losses

Every trader should understand the importance of the stop losses term. When a trader is into that activity, he needs to know when it is time to step out of the game. This decision does not depend on whether or not that person is making a profit at that point. In other words, when you are into trading, you need to establish a clear stop loss level because this strategy is going to help you cut your losses. This is one of the most effective skills but traders are rarely using it, so you can take advantage of it.

Selecting a stop loss level is a very effective tip since it helps you realize that you should not get carried away by your emotions. For instance, you can set the minimum point that you are prepared to trade your coin. In that way, if a bad outcome comes, you can get out with the amount you invested in the first place. The same thing applies when it comes to setting a profit level. This means that you need to stick to that and not be greedy.

Be prepared to manage your risks

Source: unsplash.com

One of the most important tips that you need to think about is that wise traders never, but truly never go and run in the direction of the massive profit. They know better! This means that every experienced and knowledgeable trader will rather gather small profits that are guaranteed and sure than to do what most of the traders do – chase big profits out of greediness. Therefore, take advantage of this trick next time you are trading cryptocurrency.

You should consider investing less of your portfolio in a trading market that is less liquid. Understanding that high trades require a lot more tolerance will be very beneficial for your trading outcomes. On the other hand, stop loss and profit target points are going to be distributed beyond the buying level.

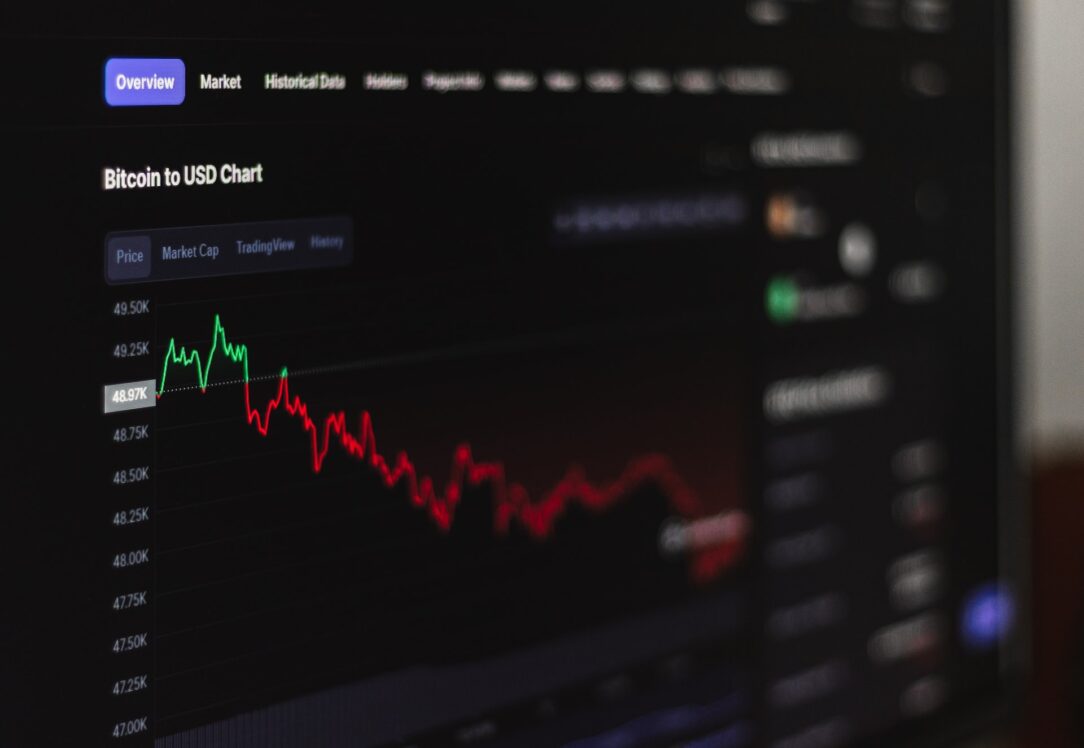

Underlying Assets Create Volatile Market Conditions

In general, what every trader should know is the fact that the prices of all coins are depending on the current market price of the Bitcoin cryptocurrency. This means that primarily as a trader you need to understand that Bitcoin is very volatile and you need to accept that. This means that when the Bitcoin value goes up, the value of altcoins will go down and contrariwise.

Logically, when it comes to Bitcoin price, the market is foggy because this prevents all traders from having a clear picture of what goes on in the trading market. Therefore, traders need to have close targets for the trades.

Never make the mistake of buying a crypto coin simply because its price is low

Source: unsplash.com

One of the most common mistakes that traders are constantly making is buying crypto coins just because they are very affordable and they want to see what will happen. However, this is not the approach you want to take. In fact, every responsible and experienced trader will never buy some crypto coin just because its price is currently low.

If you truly want to be a successful trader understand that the decision towards investing in a particular coin should have nothing to do with its affordability. It needs to have a connection with its market cap. It is way more clever to use a coin’s market cap in order to make the decision whether or not you are willing to invest in it than using its price. Moreover, you should know that the higher a coin’s market cap is, there is better the chance for investment.

Bonus tips for beginners

Finally, we hope that the previously mentioned tips will be very beneficial for your trading future. However, we wanted to save one last effective tip that can provide you as a beginner with practical steps when it comes to start implementing your trading performance. We suggest you take advantage of the goal-setting feature and you will achieve that by placing sell orders in the order books. The truth is that you will never know when your order price is going to be met, and when you are going to earn exactly what you wanted, therefore set your revenue targets with this tip. Moreover, selling orders will attract some transaction fees since they are considered market makers.

Despite this, we are suggesting you start with small steps and be relaxed while trading. You know what is the saying, the best traders are the ones that stayed cool even when things fall apart. You will not be able to develop successful trading skills immediately, you will need time. However, approach the trading activity objectively and rationally instead of emotionally.