Have you ever thought about the fate of miners when there is nothing left to mine? If not, you must know everything if you are planning to invest in digital coins. Many people avoid researching well before making an investment decision and later regret it. If you don’t want to put yourself in such a situation, you must not forget it. We have prepared this article to let you know what happens when all the bitcoins get mined. The supply of digital coins is limited to 21 million. After that, nobody will be able to mine more bitcoins.

Some people hesitate when it comes to bitcoin mining because they think it is a pretty challenging task. However, if you try and be patient with the results, you can quickly become good at it. Technology has made it possible for people to gain knowledge regarding cryptocurrency mining. There are many options for you to choose from, and it might confuse you as well. But you can visit this site to get all the solutions to every problem related to bitcoin mining.

Bitcoins’ popularity is increasing at a faster rate than before. The primary reason is that its value is improving day by day. Many investors are now considering these digital coins as the best source of investment. Also, they can earn enormous profits with the same. If you are curious to know more about bitcoins, keep reading this article till the end. We won’t disappoint you in any way.

What is bitcoin mining?

Source: internetofbusiness.com

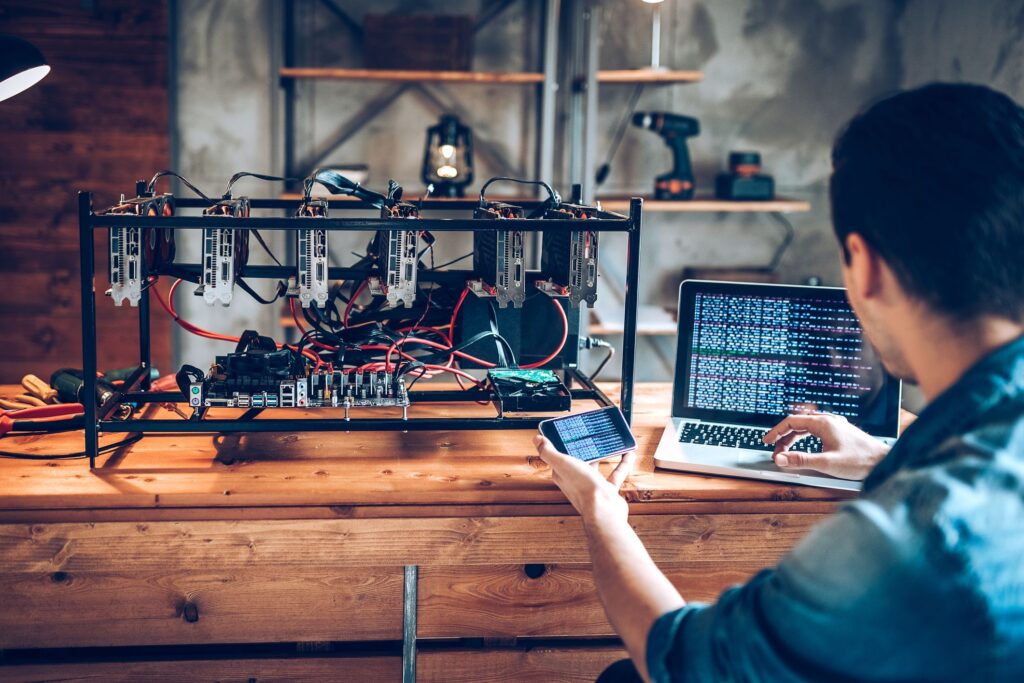

Bitcoin mining is a process in which miners add blocks to the blockchain network. Once the block is added and verified, they get a digital coin as a reward. But when the limit exceeds, they will not get more bitcoins.

It is a pretty straightforward thing to understand, even for beginners. You must need consistent practice to show your skills. Also, keep in mind that mining is not possible with a slow system. You have to get an advanced computer to make the process faster. Otherwise, it will be difficult for you to gain virtual coins.

The blockchain network allows so many users to try their luck. So, the load is always higher on it. That is why you need to purchase a high-speed processor device to become a successful miner. You might have to face increased competition in this particular process. Be well prepared for the same.

What do miners do when there is nothing left to mine?

As mentioned earlier, miners might have to face a situation someday when nothing is left to mine. Unfortunately, nobody can control the same because the supply is limited. Miners can mine only 21 million digital coins, and after that, they need to stop the process. It is the only option for them as they might not be able to earn free bitcoins. So, it will be a total loss situation.

Bitcoin halving is an event that happens after miners have reached the limit. It also occurs after every four years. This event impacts both miners and the cryptocurrency market—the value of the mined digital coins after bitcoin halving gets halved. So, everyone has to face a 50% loss. Let’s discuss the impact of bitcoin splitting on miners and the market in detail.

- Earning from the transaction fees: The miners will only get to make from the transaction fees. The earnings are not specific and can be small. You can understand that there will be no profits, and due to this, miners have to suffer for some time.

- Zero block rewards: People who tried their best to get rewards will not receive them as there is nothing left to mine.

- Increase in price: Due to a decrease in the supply of digital coins, their price might increase. So, the investors might have to buy them at high rates.

What are the essential things to know about bitcoin halving?

Halving cannot happen without mining:

Source: deficapital.com

The world of cryptocurrencies is attracting many investors nowadays. As more and more people are participating in bitcoin mining, the load on the network is also rising. So, halving might be possible anytime soon. When the limit reaches 21 million, this event will create disturbance in the market. However, there are some benefits of the same as well.

Supply gets affected:

The price of bitcoins is dependent on various factors, and supply is one of them. After bitcoin halving, the total supply of digital coins decreases. As a result, the price also increases, which makes many investors vulnerable.

You have to make your decision very carefully when such a thing happens. Cryptocurrency mining is straightforward, but you have to take care of certain things simultaneously. If you don’t follow the same, you might have to face future consequences.

No one can control it:

Source: popularmechanics.com

Well, the worst thing about bitcoin halving is that no one has control over it. It doesn’t matter how professional you are. You will not be able to resist this event from happening. There are various reasons due to which it occurs.

It has not been a long time since blockchain technology came. It is one of the reasons that many investors or miners do not understand how it works. Also, some frequent problems and issues make people scared as they are new to this technology. There is only one way to eliminate this. If every investor gains some knowledge before investing, they can smoothly start their journey.

Unpredictability:

Can you predict this event? Like, can you guess when it will happen? The answer to this question is a simple no. No matter how much knowledge you have about bitcoins, you can’t predict it.

One thing you can do is collect all the past events’ information and begin your research. But still, you won’t get accurate results.

The Bottom Line

When there is nothing left to mine, it impacts the whole market and the miners. But you don’t have to worry because that phase will end in some time. We hope you understood all the things discussed in this article.