Cryptocurrency trading is a realm laden with potentials yet shrouded in mystique, often seeming inscrutable to the uninitiated. At the heart of crypto trading lie candlestick charts, intricate yet pivotal, laying bare the heartbeat of currency prices, offering insights critical for judicious trading decisions.

This post intends to demystify the enigmatic world of cryptocurrency trading for novices, unraveling the tapestry of coins and candlesticks, making it coherent and inviting.

What Are Cryptocurrencies?

Cryptocurrencies are digital or virtual currencies utilizing cryptography for security, decentralizing control away from traditional banks or government institutions. Bitcoin, birthed in 2009, stands as the progenitor and remains the most recognized.

Ethereum follows, distinguished by its smart contract functionality. Cryptocurrencies are decentralized, governed by blockchain technology, a distributed ledger enforcing the integrity and chronological order of transactions.

Why Trade Cryptocurrencies?

Source: analyticsinsight.net

People gravitate towards cryptocurrency trading propelled by myriad motivations.

The allure of substantial profits looms large, with stories of astronomical gains fueling a gold-rush mentality. Diversification also underpins the appeal, as crypto assets correlate less to traditional market fluctuations.

The decentralized nature of crypto markets offers an alternative to conventional financial systems, resonating with those valuing autonomy and financial democracy.

Cryptocurrency Exchanges

In the trading ecosystem, cryptocurrency exchanges play a pivotal role, serving as conduits enabling users to buy, sell, or exchange cryptocurrencies. Platforms like Binance, Coinbase, and Kraken are behemoths in this space, offering diverse trading pairs, advanced features, and different transaction fees.

The choice of exchange impacts trading experience and success, mandating diligent consideration of features, security, and fees.all of that you can do at https://traders-ai.co/.

Introduction to Candlestick Charts

Originating from 17th century Japan, Candlestick charts have evolved as indispensable tools for decrypting price movements in crypto trading. These charts encapsulate diverse price movements within selected time frames, providing a nuanced visual representation of intricate price actions.

Understanding candlestick charts is pivotal, enabling traders to dissect potential market directions, making informed, pragmatic decisions, and thereby enhancing overall trading efficacy.

Mastery of this tool is foundational for any trader aspiring to navigate the complex seas of cryptocurrency trading successfully, ensuring heightened accuracy in predicting market shifts.

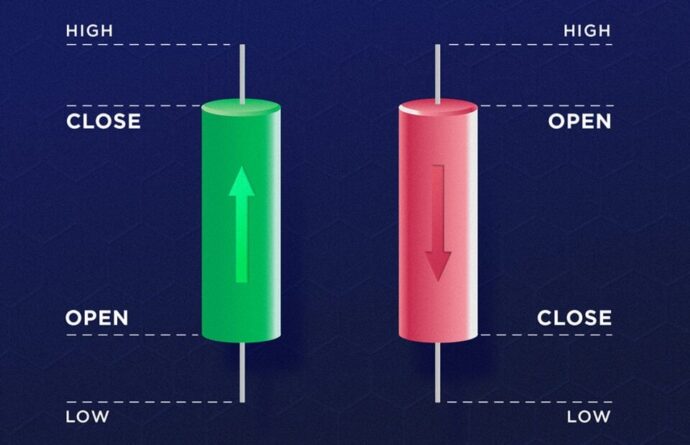

Anatomy of a Candlestick

Source: crypto.com

A candlestick is visually represented as a rectangular body, flanked by wicks or shadows, each element narrating a part of the price story. The body delineates the opening and closing prices, the pivotal price points, while the wicks reveal the highest and lowest prices reached.

The candlestick’s color, predominantly red or green, unfolds the price direction; green conveys a closing price exceeding the opening, and red indicates a decline. Deciphering these elemental components is crucial in grasping market sentiments and delineating prevailing price trends, essential insights for crafting effective trading strategies.

Types of Candlestick Patterns

Candlestick patterns like the doji, hammer, and engulfing patterns emerge as the interpreters, the Rosetta Stones, of crypto trading. The doji, recognized by its thin line, echoes market indecision, a battlefield of conflicting market forces.

The hammer heralds a potential reversal upward, a ray of hope in a downtrending market. Engulfing patterns signify powerful price reversals, indicating tectonic shifts in market sentiments.

Recognizing and understanding these patterns are pivotal, allowing traders to anticipate and adapt to market movements strategically, optimizing entry and exit points, thus enhancing the probability of success.

Reading Candlestick Charts

To proficiently read candlestick charts, one needs an analytical and discerning eye, capable of identifying patterns and trends embedded within the flux of price action. This involves meticulous scrutiny of individual candlesticks and their series, interpreting emerging patterns, and deducing probable future movements.

The market is replete with examples showcasing varied scenarios, from bullish engulfing patterns signaling potential uptrends to dojis portraying market uncertainty.

These visual cues are pivotal, enabling traders to translate nuanced market narratives into actionable, informed insights, aligning their trades with the pulse of the market.

Technical Analysis in Crypto Trading

Source: cryptopotato.com

Technical analysis stands as the cornerstone in crafting cryptocurrency trading decisions, employing statistical and analytical methodologies to predict future price movements based on historical data and discerned trends.

In this analytical domain, the importance of candlestick patterns is magnified, offering traders nuanced insights into the ebbs and flows of market sentiment and prospective price trajectories.

This analytical mastery allows traders to synchronize their strategies with the market’s pulse, balancing risk and reward, maximizing gains while mitigating potential pitfalls, and shaping a more informed and resilient trading approach.

Risk Management

Risk management is the unsung hero, the vigilant guardian in cryptocurrency trading, pivotal for safeguarding capital and optimizing profits.

This multifaceted strategy involves the implementation of judicious protective measures like setting stop-loss orders to curtail losses and employing prudent position sizing to manage risk exposure effectively.

In the tempestuous and unpredictable seas of market volatility, risk management serves as the steadfast anchor, ensuring the trader’s journey remains unhindered and focused, even amidst the most tumultuous market conditions, enhancing long-term trading resilience and success.

Choosing the Right Trading Strategy

A trading strategy is the compass, the guiding beacon in the vast ocean of trading decisions. The spectrum of strategies is broad and diverse, ranging from day trading, which focuses on leveraging short-term movements, to swing trading, which capitalizes on price momentum, and to long-term investing grounded in profound fundamental analysis.

Across this vast strategic landscape, the relevance and utility of candlestick patterns are omnipresent, providing pivotal insights into the underlying market temperament and emerging movements.

This invaluable knowledge enables traders to align and adapt their strategies seamlessly with the rhythmic dance of the market, optimizing their trading trajectories.

Conclusion

Source: gadgets360.com

Embarking on the journey of cryptocurrency trading is akin to navigating uncharted waters, filled with promise yet fraught with peril. The interplay of coins and candlesticks forms the bedrock of this odyssey.

The understanding of cryptocurrencies, the rationale behind trading them, the role of exchanges, and the mastery of candlestick charts and patterns are pivotal in steering the trading ship through the turbulent crypto seas towards the shores of trading success.

The quest for knowledge and discernment is unending, beckoning aspirants to delve deeper, practice assiduously, and trade judiciously.